HSN Code GST Rate for Printed Books Newspapers and Postal goods - Chapter 49. 6-XXXX with a FRE code.

The Maharashtra Stamp Act is amended and Amendment was published in Maharashtra Government Gazette on the 24th April 2015.

. As per the Indian Penal Code not paying the required stamp duty is a criminal offence. XX OF 2015 and this act may be called Maharashtra Stamp Amendment Act 2015 notified on 24042015. But my question is more about the stamp duty and income tax destructibility.

The main provisions of the Singapore Income Tax Law. A key finding was to increase the good and services tax GST above its current rate of 10 per cent and abolish stamp duty. Once licensed you are required to.

Registration Of Documents Once you pay the stamp duty the document has to be registered under the Indian Registration Act with a sub-registrar. Firstly Stamp duty on. Stamp duty on LLP agreement and MOA is amended by MAHARASHTRA ACT No.

A share certificate is a certificate given to the equity shareholder of the company in the form SH-1. Such delays in payment can make the individual liable to pay a hefty fine ranging from 2 to 200 of the total payable amount. From my understanding these stamp duties imposed are related to income generating purpose.

With a few exceptions a cannabis excise stamp must be present on all of your cannabis products that are available for purchase. ONLINE PAYMENT OF STAMP DUTY ON SHARE CERTIFICATES. This registrar should be of the jurisdiction where the property is.

Say if the stamp duty for the sale deed is 55 then you need to pay only 54 because you already paid a franking charge of 01. Purchase and apply cannabis excise stamps to your products if you package cannabis products Calculate the duty on your sales. The stamp duty is to be made by the purchaser or buyer and not the seller Ask Free Legal advice.

Is ruled by the Income Tax Act ITA the Economic Expansion Incentives Act EEIA the Goods and Services Tax GST Act and the Stamp Duties Act. If I paid 20000 stamp duty on the purchase of a property I would probably put this to. File your monthly return and remit excise duty to the CRA.

Documents that require stamp duty. Were pleased to advise that on 1 June 2022 National Australia Bank Limited NAB acquired the consumer banking business from Citigroup Pty Ltd Citi and appointed Citi to provide transitional services. No liability to duty arises in relation to a conveyance or transfer of an interest in non-residential and non-primary production land qualifying land executed on or after 1 July 2018 subject to the conveyance or transfer of an interest not arising from a contract of sale or other transaction entered into before 1 July 2018.

In this case the board may register the transfer on specific terms of indemnity as it thinks fit. Stock share or bond certificates and similar documents of titleother than duty credit scrips. Stamp Duty Electricity Duty Author CA Chitresh Gupta BComH FCA IFRS Certified IDT Certified is Author of Book An Insight Into Goods Service Tax and also Managing Partner at Ms Chitresh Gupta Associates and can be reached at M 9910367918 Email Id.

The stamp duty must be paid no later than 14 days after. In this article we describe briefly the tax code in Singapore. Affix the same value stamp on a written application if the signed transfer deed has been lost.

If the shares of the company are listed in a recognized stock exchange then the company cannot charge any fee for the registration of transfers of. Stamp duty on share certificate is a state-related matter where delay in payment of stamp duty appeals penalty. 1000 on every rs5 lakhs of amount of increase in authorised capital or part thereof subject to a maximum of 50 lakhs of stamp duty.

2500000000- no stamp duty shall be payable. Stamp duty shall be rs. Share certificate being an instrument requires stamping.

Thanks for explaining the relationship stamp duty and GST. However in the case of increase of authorised capital beyond rs.

Export Basmati Rice Basmati Rice Basmati Indian Rice Basmati

Gst On Real Estate 5 On Under Construction 1 On Affordable Housing

Gst Registration What Is It And How To Conduct Gst Registration Online

Gst State Code List And Jurisdiction 2022

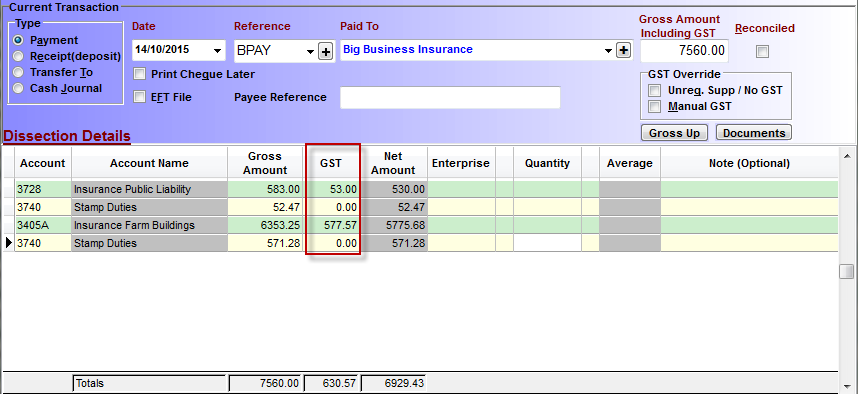

Gst Free And Non Reportable Ps Support

What Next For Gst The Financial Express

Gst Registration A Game Changer For Most Of The Industries

Kbc Helpline Whatsapp Number 9313473098 Online Customer Service Customer Service Customer Care

Floor Plan Raunak Supreme Code Liv Large Floor Plans Large Floor Plans How To Plan

The Correct Tax Rate And Account Code For Imports And Duty

Baroque Rococo Bow Gold Retro Vintage Frame Mirror Oval Home Etsy Fancy Mirrors Vintage Frames Mirror Frames

Pin By The Taxtalk On Income Tax In 2021 Memes Coding Income Tax

What Is The Taxable Value Of Supply Under Gst Quickbooks

Lodha Gardenia Residences Mumbai Ad Toi Mumbai 10 10 2020 Real Estates Design Real Estate Brochures Property Ad

Gst Goods And Services Tax Meaning Full Form Types Housing News

Conveyance Deed Explained Hindi Conveyance Deed Kya Hoti Hai Aur Kis Tarah Ke Property Rights Transfer Hote Hai Finance Buying Property Videos Tutorial